Breaking Travel News investigates: New hospitality giant created as Marriott acquires Starwood

Ritz Carlton Jeddah will be a flag-ship property for the new group

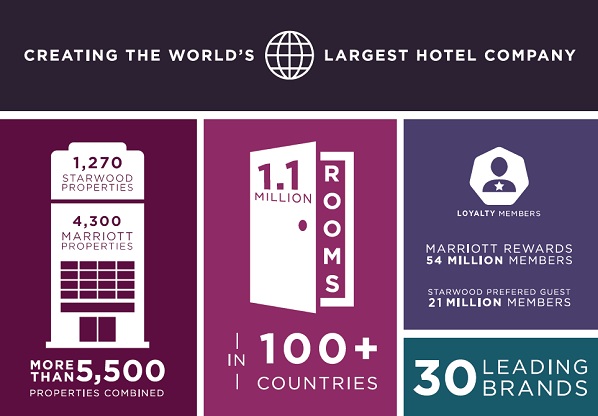

Marriott International has completed its acquisition of Starwood Hotels & Resorts Worldwide, creating the largest hotel company in the world.

The deal was finalised today as the Chinese Ministry of Commerce granted its approval, removing the last barrier to the transition.

The deal brings together a host of world-beating brands, with Marriott operating The Ritz-Carlton, Bulgari Hotels & Resorts, Moxy Hotels and JW Marriott among many others.

At the same time, Starwood brings Sheraton, W Hotels, Westin and The St. Regis to the table.

Among the newly created portfolio are the Ritz-Carlton Riyadh – set to welcome the AMEX World Luxury Expo in early 2017 – and The St. Regis Dubai, which will host the World Travel Awards Middle East Gala Ceremony later this month.

The boards of directors of both companies unanimously approved a definitive merger agreement earlier this year.

The transaction combines Starwood’s leading lifestyle brands and international footprint with Marriott’s strong presence in the luxury and select-service tiers, as well as the convention and resort segment, creating a more comprehensive portfolio.

Breaking news: Marriott International is now the world's largest hotel company https://t.co/rvwPw1pPdu pic.twitter.com/qv2oVI0eN6

— Marriott Internat'l (@MarriottIntl) September 23, 2016

The merged company will offer broader choice for guests, greater opportunities for associates and should unlock additional value for Marriott and Starwood shareholders.

Combined, the companies operate or franchise more than 5,500 hotels with 1.1 million rooms worldwide.

The combined company’s pro forma fee revenue for the 12 months ended September 30th, 2015 totals over $2.7 billion.

Starwood saw its shares cease trading on the New York Stock Exchange this morning.

Shareholders in Starwood will receive $21.00 in cash and 0.80 shares of Marriott International Class A common stock for each share of Starwood Hotels & Resorts Worldwide common stock.

Former Starwood shareholders will be entitled to receive Marriott’s quarterly cash dividend of $0.30 per share of Marriott common stock that Marriott’s board of directors declared on September 13th and which is payable to all Marriott shareholders of record at the close of business today.

In that case, Starwood’s former public shareholders will not receive the dividend declared by Starwood’s board of directors on September 13th, 2016.

Commenting on the deal Kevin Rolfe, group editorial director at VENDS, said: “Following the merger between the two giants of the hotel industry, Starwood and Marriott, one of the biggest challenges facing Marriott will be connecting with travellers and the promotion of the new combined loyalty program which will have to be rolled out over the coming months.

“Travellers tend to be less engaged with hotel loyalty programs than airline loyalty programs.

“Atmosphere Research has found that while 28 per cent of hotel guests belong to hotel loyalty programs, 40 per cent of air travellers belong to airline programs.

“The use of social media, already a major platform for the Marriott’s marketing for its individual brands will be crucial in conveying the benefits of the new enlarged Marriott’s reward program to its already large customer base, and more importantly potential new customers.”

Marriott expects to deliver at least $200 million in annual cost savings in the second full year after closing.

This will be accomplished by leveraging operating and general and administrative expense efficiencies:

- Accretive to earnings: Marriott expects the transaction to be earnings accretive by the second year after the merger, not including the impact of transaction and transition costs. Earnings will benefit from post-transaction asset sales, increased efficiencies and accelerated unit growth.

- Significant capital recycling program: Marriott expects Starwood to continue its capital recycling program, generating an estimated $1.5 to $2.0 billion of after-tax proceeds from the sale of owned hotels over the next two years. The hotels are expected to be sold subject to long-term operating agreements.

- Continued strong returns to shareholders: On a pro forma combined basis, Marriott and Starwood generated $2.7 billion in fee revenue in the 12 months ending September 2015. In 2015, Marriott expects to return at least $2.25 billion in dividends and share repurchases to shareholders. Marriott believes it can return at least as much in the first year following the merger.

- Accelerated global growth: Marriott International expects to accelerate the growth of Starwood’s brands, leveraging Marriott’s worldwide development organisation and owner and franchisee relationships. The combined company will have a broader global footprint, strengthening Marriott’s ability to serve guests wherever they travel.

- Lifestyle leader: Starwood’s first-mover advantage in the lifestyle category, along with Marriott’s broad range of brands in this segment, positions the combined company as a leader in the lifestyle space. With Marriott’s strong owner and franchisee relationships, the combined company expects growth of its lifestyle brands to accelerate.

- World-class associates: This combination brings together two of the most talented teams in the industry. Together, they will combine their innovative ideas and service commitment to deliver unforgettable guest experiences.

Arne Sorenson, president Marriott International, said: “The driving force behind this transaction is growth.

“This is an opportunity to create value by combining the distribution and strengths of Marriott and Starwood, enhancing our competitiveness in a quickly evolving marketplace.

“This greater scale should offer a wider choice of brands to consumers, improve economics to owners and franchisees, increase unit growth and enhance long-term value to shareholders.

“Today is the start of an incredible journey for our two companies.

“We expect to benefit from the best talent from both companies as we position ourselves for the future.”

Arne Sorenson will continue to lead the new company

One-time transaction costs for the merger are expected to total approximately $100 to $150 million.

Transition costs are expected to be incurred over the next two years.

Marriott will assume Starwood’s recourse debt at the closing of the transaction.

Following the transition Arne Sorenson will remain president and chief executive of Marriott International.

Marriott’s headquarters will also remain in Bethesda, Maryland.

Marriott’s board of directors following the closing will increase from 11 to 14 members with the addition of three members of the Starwood Board of Directors.

Al Habtoor City in Dubai is one of the most exciting developments in the Starwood pipeline, welcoming The St. Regis Dubai, W Dubai and The Westin Dubai to the hospitality market

J.W. Marriott, Jr., executive chairman and chairman of the board of Marriott International, said: “We have competed with Starwood for decades and we have also admired them.

“I’m excited we will add great new hotels to our system and for the incredible opportunities for Starwood and Marriott associates.

“I’m delighted to welcome Starwood to the Marriott family.”

Both brands have been successful in a variety of fields in the recent past, picking up a host of awards.

Starwood Hotels & Resorts has seen The St. Regis Doha recognised as the World’s Leading Conference Hotel by the World Travel Awards, for example, while the W Doha Hotel & Residences took the title of World’s Leading Hotel Residences.

At the same time, JW Marriot Marquis Dubai has itself taken a number of awards.

Bruce Duncan, chairman of the board of directors of Starwood Hotels & Resorts Worldwide, said: “During our comprehensive review of strategic and financial alternatives, it was clear that our talented people, world-class brands, global leadership and spirit of innovation were much admired and key drivers of our value.

“Our board concluded that a combination with Marriott provides the greatest long-term value for our shareholders and the strongest and most certain path forward for our company.

“Starwood shareholders will benefit from ownership in one of the world’s most respected companies, with vast growth potential further enhanced by cost synergies.”

The St. Regis Doha is a jewel in the Starwood crown

Starwood Hotels has a long heritage in the industry, beginning as we know it today out of Starwood Capital Partners, a Chicago-based real estate company headed by Barry Sternlicht, in 1991.

In 1995, the group acquired Hotel Investors Trust and Hotel Investors Corporation, allowing allowed Starwood to buy up a slew of properties, with more than 60 in the portfolio by 1996.

It eventually became Starwood Lodging in 1996 and in 1999, it changed from a real estate investment trust to a corporation.

In 1997 Starwood bought Westin for $1.8 billion and ITT Sheraton Corporation for $14.3 billion, giving the chain a portfolio of 650 hotels in 70 countries.

Launching W Hotels the following year Starwood effectively created the ‘boutique’ segment which has become so ubiquitous today.

More recently, the Starwood Preferred Guest loyalty program, with its lack of blackout dates and capacity controls, has become the industry standard, while the group was also the first to appear on Snapchat and Instagram.

These strengths, and many more, will now be incorporated into the Marriott behemoth.