Supreme Key consortium snaps up InterContinental Hong Kong for $940m

InterContinental Hotels Group has agreed to sell its ownership interest in InterContinental Hong Kong to Supreme Key for US$938 million.

The buyer, a consortium of investors advised and managed by Gaw Capital Partners, has paid a cash deposit to IHG of $94 million, with the remaining proceeds payable in cash on completion.

Supreme Key has also made a further commitment to invest in a significant refurbishment of the hotel.

This is expected to commence in 2017 and will take place over a period of approximately 18 months.

IHG will retain a 37-year management contract on the hotel, with three ten-year extension rights, giving an expected contract length of 67 years.

ADVERTISEMENT

Management fees payable to IHG are initially expected to be approximately $8 million per annum, increasing following the refurbishment.

Richard Solomons, chief executive of IHG commented: “The InterContinental Hong Kong is an exceptional property and an iconic hotel in our portfolio.

“This sale highlights the enduring appeal of InterContinental as one of the world’s leading luxury hotel brands.

“We are very pleased to be working closely with a highly regarded hotel investor that will be a great partner for IHG and with whom we look forward to building a successful long term relationship.”

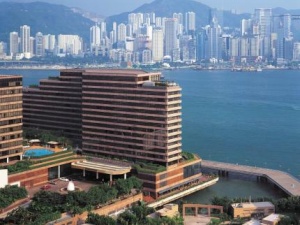

The hotel is internationally-acclaimed as one of the world’s most famous hotels, with a five-star rating from the Forbes Travel Guide, three Michelin-starred restaurants, and a wide range of state-of-the-art meeting and banqueting facilities.

It is situated on the Kowloon waterfront, with unrivalled panoramic views of Victoria Harbour and Hong Kong’s skyline. The Hotel opened in 1980 and has 503 guest rooms, including 87 suites, and has been wholly owned by IHG and operated under the InterContinental brand since 2001.

In 2014, the hotel generated EBIT of $42 million, and, as at December 31st 2014, had a net book value of $298 million.

The transaction will give rise to an estimated exceptional pre-tax profit on disposal of $700 million, with an estimated exceptional non-cash tax charge of $40 million.

The transaction is scheduled to complete in the second half of 2015.

A decision on a return of funds to shareholders from these proceeds, alongside those received from the sale of InterContinental Paris - Le Grand, will be announced at preliminary results in February 2016.

“This transaction completes the disposals of our major owned assets.

“Since our formation in 2003 we have disposed of almost 200 hotels for gross proceeds of almost $8 billion, and have returned over $10 billion to our shareholders.

“Looking forward, we will continue to focus on the disciplined execution of our winning strategy for sustainable high quality growth.”