Destinations & the Online Marketing Disconnect

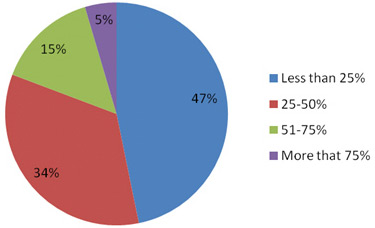

I recently conducted a webinar on key distribution trends for 2009-2010 for the Southeast Tourism Society, and organization of more than 900 destination marketing organizations (DMOs), travel suppliers and other companies involved in the marketing and promotion of travel and tourism to the Southeast United States. About 15 minutes into the Webinar, I posed this polling question to attendees: “What percentage of your leisure marketing expenditure is spent for online marketing?” A total of 109 attendees responded. Here are the results:

Figure 1: Online Marketing Spend as a Percentage of Total Leisure Marketing Spend for DMOs in the Southeast.

Base: Members of Southeast Tourism Society; N=109

Source: Poll in Webinar “Key Directions in Travel Distribution” conducted by PhoCusWright and the Southeast Tourism Society.

The results indicate that nearly four out of five respondents spend less than half of their budgets on online channels, and nearly half – 47% — devote less than a quarter of their marketing spend to online outlets. These results are fairly consistent with those shown in PhoCusWright’s Destination Marketing: Understanding the Role and Impact of Destination Marketers, our recent, major research study covering destination marketing organizations which found that the average DMO spent about 37% of their marketing budget on online marketing.

ADVERTISEMENT

I made the point during the Webinar that this is low, considering the extent to which travelers are using the Web vs. offline channels to research, plan, shop and purchase travel. Here is why: our consumer research clearly indicates that leisure travelers use the Internet far more than offline outlets to research, plan and shop for travel.

• Trip inspiration: the Internet is the second most important source, second only to family and friends, and far more important than print media.

• Destination selection: More than half of all leisure travelers have used the Internet to select their destination

• Shopping: well over 80% say the Internet is their usual channel for travel shopping (all print media outlets fall under 30%)

• Purchasing: also well over 80%, however there are significant variations by various travel product types and traveler segments.

We also found in PhoCusWright’s Destination Marketing: Understanding the Role and Impact of Destination Marketers that 82% of consumers who use a DMO at any time when researching and planning their travels visit a DMO Web site. Furthermore, 97% of visitors to DMO Web sites arrive there via a search engine.

So, considering how important the Internet is in the travel planning process and how relatively little DMOs appear to devote to online marketing as a percentage of their total expenditure, we believe there is a disconnect. Many attendees of the Webinar had a number of comments and questions around this data and my assessment of it. Several comments had to do with the relative cost of online marketing, that it is much less expensive than offline marketing. One gentleman said they were already appearing at the top of search engine results and really could not spend much more.

Here are some observations and questions:

Online marketing’s relative cost: Online marketing may or may not be less expensive, but the cost of any marketing channel should be judged relative to its value, or return on investment. If a DMO can tie a majority of its Web site traffic and arrival numbers to online marketing sources but only spends a fraction of its budget online, what would be the potential to increase that activity by shifting some of that marketing spend from offline to online? (And, by the way, online marketing offers much better means of measuring ROI, vs. offline expenditure.)

SEO, SEM and SMO: Does your Web site appear at the top of the results for keywords around your destination? If so, that is impressive. What about some of the key attributes or attractions of your destination? If your destination has great beaches, golf or tennis, how do you fare in keyword sets related to those activities? Do you appear on page one or 101?

Social Media: Have you allocated sufficient resources to engage in the growing array of social media outlets? Have you developed a sufficient mix of social content for your Web site as well as the major social networks and content sites? Some 65% of DMO Web site visitors tell us that travel reviews are important, yet less than 30% of DMOs have such reviews on their sites. Does yours?

What is your overall spend in terms of dollars, time and human capital on various channels versus their measurable return? This is the key question. Do you know where your inquiries (online and offline), visitors (online and offline) and destination spend is generated? Our research indicates that a bigger piece all of those elements is likely generated via the Internet. So, think about all of the things you did over the past week, the time and money spent on various activities. Was this allocation proportional to the relative importance of these channels to driving visitors to your Web site and ultimate to your destination?

We are not suggesting that every DMO immediately move all of their spend from offline to online, from print ads to keyword buys. Far from it. All destination marketers must assess the attributes and dynamics of their destination and offerings, and map their marketing plans accordingly. But I return to this key question: what is your overall spend in terms of dollars, time and human capital on various channels versus their measurable return? (And if they are not aligned, what might happen if you devoted more resources to those outlets that were generating a higher return?).

Thanks again to everyone who participated in the Webinar. I welcome your feedback!