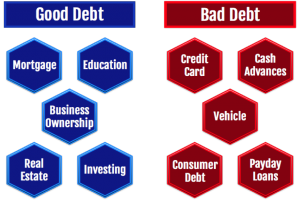

Good Debt vs Bad Debt

A comparison of good and bad debt

A comparison of good and bad debt Most people believe that being in debt is a bad thing. It is taken as a sign of financial difficulties. That is not necessarily true. If you take on debt that generates an income for you and more than covers the cost of capital, then it is good debt.

If you look at businesses, every firm from the smallest sole proprietorship to the largest corporation takes on long or short term debt to meet their financing debts. Debt is often much cheaper and more easy to manage than equity.

Good Debt

In a free market capitalist society, you need money to make money. Debt is good for you if it helps you accumulate knowledge, skills or assets that will make you money in the future.

College Education Loans

Consider the loan you take on for a college education. A professional college degree increases your chances of landing a good job. It improves your ability to negotiate promotions and pay raises. Since it is debt that helps you make more money, it isn’t necessarily a bad kind of debt.

Starting a Business

If you have the skill and experience to run your own business successfully and the only limiting factor is finance, then you should consider taking on a personal or business loan. As your business generates profit, you can pay off the loan and have an established business on your hands.

Asset Investment

If you are taking a loan to invest in commodities, shares or stock that is expected to appreciate in value in the future, then you can consider it good debt. As long as you make a profit on the investment that covers the cost of your loan, you can consider it good.

Real estate, land, and property investment also fall in this category. This is why a mortgage is often considered a good kind of debt.

Medical Care

Many people incur debt due to medical care and emergency treatment. While you can repay debt incurred on healthcare, you cannot replace a human life. The debt you incur on medical treatment is a good kind of debt.

Bad Debt

Bad debt is any kind of debt that is charged at a high interest rate, does not give you an income and puts you under financial pressure. It includes the following:

Retail Shopping Debt

If you spend a lot of money buying expensive jewellery, shoes, clothing or fashion accessory and incur debt on the shopping, then it is a bad kind of debt.

Credit Card Debt

Credit cards are useful for short term financing and you must clear the balance within due date to get the best out of them. However, they usually charge a very high APR and should not be used for long-term financing. A solution to credit card debt could be an IVA (individual voluntary arrangement).

Vacations and Entertainment

You should never use borrowed money for entertainment purposes. Going on an expensive holiday on a loan may seem like a good idea while you are on the trip, but it could leave you stressed out for months later until you clear the debt.

Expensive Weddings or Social Gatherings

Many newlyweds end up with a large bill on wedding expenses and it can take years to settle the debt. This is a bad form of debt that should be avoided.

Payday Loans

Payday loans are charged at a very high rate and can leave you in a vicious cycle of debt. You clear the debt when you get paid, leaving you with very little money to do manage your monthly expenses. You end up borrowing again over the course of the month, settling the debt with your next salary. It can become very difficult to get out of this loan cycle. This kind of debt should be avoided at all costs.