Etihad Airways seeks finance for fleet expansion

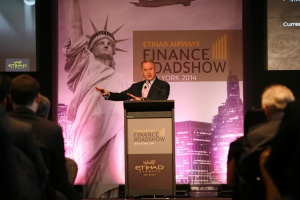

Etihad Airways, the national airline of the United Arab Emirates, has hosted the latest edition of its highly successful financial roadshows in New York and London, attracting a record number of guests.

Led by James Hogan, Etihad Airways’ president, and supported by James Rigney, chief financial officer, and Ricky Thirion, group treasurer, the roadshows welcomed more than four hundred representatives from many of the world’s largest financial institutions, lessors and other partners.

The roadshows are conducted annually in major global and regional financial centres including New York, London and Sydney, and offer an ideal opportunity for the airline to brief the world’s leading financiers about its expansion strategy as well as deepen existing ties.

The airline is looking to raise US$2 billion to finance its fleet deliveries in 2014 which will include its first A380 and Boeing 787 aircraft.

Hogan said “Etihad Airways continues to expand its relationships with financial institutions in markets around the world, which in turn play a crucial role in the expansion of the airline’s global network and fleet of aircraft.

“The financial institutions view Etihad Airways as a strong counterparty, that is financially stable with a strong track record in safety, and we are always eager to spend time with them to communicate our latest developments.”

Earlier this month Etihad Airways announced a record net profit of US$62 million in 2013, up 48 per cent, marking the third successive year of net profitability.

The airline also generated revenues of more than US$6 billion last year.

Etihad Airways has raised more than US$8 billion in funding from 68 financial institutions during the past ten years to finance aircraft and engines.

In addition to expanding the relationships with lessors and lending institutions, Etihad Airways has an efficient risk management policy to manage the financial risks related to fuel price, foreign exchange, interest rates and emissions.

This has enhanced the airline’s reputation for successful fiscal discipline and cost control.

Etihad Airways’ hedging strategy has received widespread praise from the financial community.

Currently it is hedged at 76 per cent for 2014, 48 per cent for 2015, 15 per cent for 2016, and three per cent for quarter one of 2017.

During the past 12 months Etihad Airways has continued to expand its four pillared strategy of organic growth, codeshare and interline partnerships, equity alliance in other airlines and aviation related businesses, and franchise partners.

In addition to the four existing equity partners – airberlin, Air Seychelles, Virgin Australia and Aer Lingus – Etihad Airways announced investments in three additional carriers in 2013.

Stakes were acquired in Jet Airways, Air Serbia (formally Jat Airways) and Darwin Airline, a regional carrier based in Switzerland which has become a new sub-brand called, Etihad Regional (subject to regulatory approval).

Etihad Airways made the largest aircraft order in its history in 2013, with orders, options and purchase rights for up to 199 Airbus and Boeing aircraft, valued at up to US$67 billion.