Hilton overcomes fears to report strong financial results for 2018

Hilton has seen its shares surge following the release of its financial results for 2018.

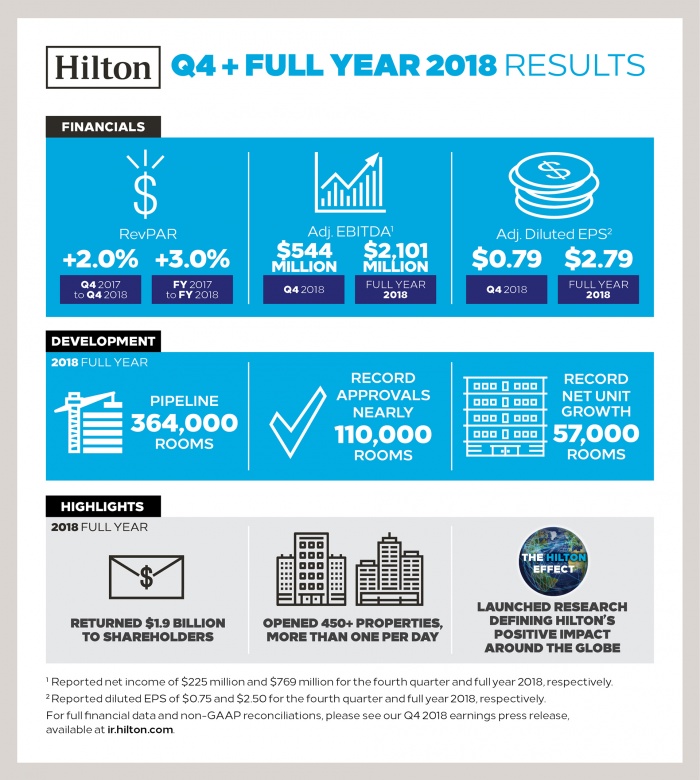

Providing a better-than-feared outlook for its key United States and China markets, the hotel giant said net income for the full year stood at $769 million.

The news sent shares up seven per cent.

There had been concerns around slowing global economic growth and a trade war between the United States and China, but the impact appears to have been moderate at this stage.

Adjusted EBITDA for the full year, exceeding the high end of guidance, stood at $2,101 million.

ADVERTISEMENT

System-wide comparable RevPAR at Hilton increased three percent for the full year on a currency neutral basis.

Christopher Nassetta, president, Hilton, said: “We are pleased with our fourth quarter and full year results, exceeding the high end of our guidance for adjusted EBITDA and diluted earnings per share, adjusted for special items, driven in part by better than expected net unit growth, up roughly seven percent versus the prior year.

“In particular, we continued to expand our luxury portfolio with several exciting openings and the launch of our luxury collection brand, LXR Hotels & Resorts.”

Diluted earnings per share stood at $2.50 for the full year, while diluted earnings per share, adjusted for special items, came in at $2.79 for the full year.

Hilton recently launched LXR Hotels & Resorts, a new luxury brand.

The first property, the Habtoor Palace Dubai, was converted from St. Regis and opened in the second half of 2018.

The company approved 24,900 new rooms for development during the fourth quarter of the year, growing Hilton’s development pipeline to more than 364,000 rooms as of December last year.

This represents six per cent growth from December 2017.

Looking ahead, Hilton said full year system-wide RevPAR is expected to increase between one and three per cent in 2019 on a comparable and currency neutral basis

Full year adjusted EBITDA is projected to be between $2,240 million and $2,290 million.

“We expect continued strength in room growth, combined with RevPAR growth, to provide a good setup for the year ahead,” concluded Nassetta.