Travelport initial public offering values company at $1.9bn

Travelport has announced it has commenced an initial public offering of 30 million of its common shares, priced at $14 to $16.

The deal, which seeks to raise $480 million, would value the company at $1.9 billion at the top end of expectations.

Travelport links airlines and hotel chains with travel agencies and other ticket buyers, competes with travel distributors such as Abacus and Amadeus.

Blackstone and Technology Crossover Ventures bought the Atlanta, Georgia-based company for $4.3 billion from conglomerate Cendant in 2006.

Travelport, which saw net loss widened to $27 million in the three months ended March 31st, from $22 million a year earlier, scrapped its plans to list in London in 2010, citing poor market conditions.

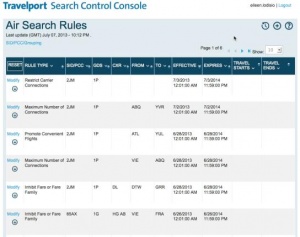

Travelport is a travel commerce platform providing distribution, technology, payment and other solutions for the $7 trillion global travel and tourism industry.

It is comprised of a Travel Commerce Platform, through which it facilitates travel commerce by connecting the world’s leading travel providers with online and offline travel buyers in a business-to-business travel marketplace; and its Technology

Services, through which it provides critical IT services to airlines, such as shopping, ticketing, departure control and other solutions, enabling them to focus on their core business competencies and reduce costs.

Morgan Stanley, UBS Investment Bank, Credit Suisse and Deutsche Bank Securities are serving as joint book-running managers for the offering.

Cowen and Company, Evercore, Jefferies, Sandford C. Bernstein and William Blair are serving as co-managers for the Offering.