IATA 2013: Strong performance sustains profitability

The International Air Transport Association has upgraded its global outlook for the airline industry to a $12.7 billion profit in 2013 on $711 billion in revenues.

This is $2.1 billion better than the $10.6 billion profit projected in March of this year and an improvement on the $7.6 billion profit generated in 2012.

On revenues that are expected to total $711 billion this year, the net profit margin is expected to be 1.8 per cent.

Indicative of the characteristically razor thin profits of the airline industry, even this small margin will make 2013 the third strongest year for airlines since the events of 2001.

In 2007 the industry earned 2.9 per cent net profit margin ($14.7 billion) and in 2010 airlines generated a 3.3 per cent net profit margin ($19.2 billion).

“This is a very tough business.

“The day-to-day challenges of keeping revenues ahead of costs remain monumental.

“Many airlines are struggling.

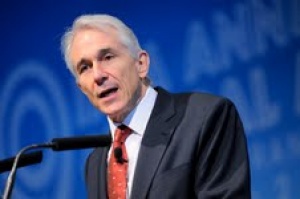

“On average airlines will earn about $4 for every passenger carried - less than the cost of a sandwich in most places,” said Tony Tyler, IATA director general.

Profitability is thin, but there is a solid performance improvement story over the last seven to eight years.

More efficient use of assets is the main contributor.

The industry load factor is expected to average a record high of 80.3 per cent in 2013 – six percentage points above 2006 levels.

Additionally, airlines have found new sources of value that have increased the contribution of ancillary revenues from 0.5 per cent in 2007 to over five per cent in 2013.

Macro-economic factors have also contributed.

Oil prices are expected to average $108/barrel (Brent), a little below the $111.8 average for 2012, in part due to increasing supply from North America.

Meanwhile, the outlook for global economic growth has deteriorated slightly since March as the recession in Europe proves to be deeper than expected.

The beneficial impact of lower fuel prices is expected to offset the adverse effect of weaker economic growth, providing a moderate boost to industry profitability.

“Generating even small profits with oil prices at $108/barrel and a weak economic outlook is a major achievement.

“Improved performance is what’s keeping airlines in the black. Airlines are putting more people in seats.

“For the first time in history, the industry load factor is expected to average above 80 per cent for the year.

“And with ancillary revenues topping five per cent, it is clear that airlines have found new ways to add value to the travel experience and to shore-up the bottom line,” said Tyler.