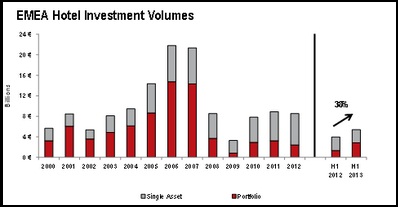

EMEA hotel transaction volumes rise by 38% in the first 6 months of 2013

Hotel investment volumes in H1 2013 in Europe, Middle East and Africa increased by 38% to €5.5 billion, when compared to H1 2012. This growth was primarily in Q1 2013 (+45%) and to some extent in Q2 2013 (+22%).

The first half of 2013 re-emphasised the importance of Middle Eastern capital which almost tripled from €745 million in H1 2012 to €2.1 billion in H1 2013 (+282%). Key players were once again sovereign wealth funds from Qatar and Abu Dhabi which continued to deploy their capital in core European markets. Global investors such as Westmont, Starwood Capital and Morgan Stanley were the second largest group of investors with a market share of 20% of invested capital, followed by domestic investors with a market share of 18%.

Transaction activity was driven by portfolio deals where investment volumes more than doubled (+116%) when compared to the first half of 2012. Major portfolio deals included 42 UK Marriott hotels, four Groupe du Louvre hotels in France and the Principal Hayley portfolio of 27 UK hotels. These top three deals totalled €1.8 billion, representing 33% of the total transaction volume across EMEA.

The first half of 2013 was also marked by various trophy deals such as the 447 room InterContinental London Park Lane which was acquired for €359 million and the 138 room Mandarin Oriental Paris which sold for €290 million including two retail units, reflecting an impressive price per key of €1.5 million, excluding the retail units.

ADVERTISEMENT

The UK remained the most active transaction market with investment volumes amounting to €2.3 billion (41% of total EMEA volumes) followed by France at €1.3 billion (23%) and Germany in third place at €642 million (12%).

Jonathan Hubbard, CEO Northern Europe for Jones Lang LaSalle’s Hotels & Hospitality Group said, “The year has had an extremely good start with investment activity accelerating in a number of key markets. Given the improvement in financing conditions we can expect 2013 volumes to exceed our initial forecast of €8.5 billion.”

Christoph Härle, CEO Continental Europe for Jones Lang LaSalle’s Hotels & Hospitality Group said, “We have seen a very strong pickup in hotel transaction activity, particularly in Q1. Again led by the UK and France with Germany and Benelux markets displaying improved activity. This is being fuelled by a strong pipeline of opportunities coming to the market and a closing of the spread between buyer and seller pricing expectations, not least driven by more readily available debt financing, both from traditional as well as new sources of debt.”