Russian hotel downturn hampers huge potential

Russian hoteliers could be in for a bumpy ride this year, after Moscow experienced the first signs of the economic downturn, with a five-point drop in chain hotel Occupancy Rate (OR) for 2008, reaching 70%.

Russian hoteliers could be in for a bumpy ride this year, after Moscow experienced the first signs of the economic downturn, with a five-point drop in chain hotel Occupancy Rate (OR) for 2008, reaching 70%.

Average Daily Rate (ADR) ended the year at €251, only a 5% increase compared to 2007, whilst Revenue per Available Room (RevPAR) decreased slightly to €175, according to latest figures from MKG Hospitality.“These performance indicators released by our market monitoring database, Hotel CompSet, clearly illustrate the first phase of the downward cycle. Although Russia is an emerging market for hotel developers, and indeed will become a goldmine destination in the years ahead, the economic crisis has hindered performance in 2008,” stated Director of Development, MKG Hospitality, Vanguelis Panayotis.

This drop in OR was also fuelled by many new hotel openings in 2008, increasing competition. “Soon we will see ADR decreasing, as demand will continue to be low and hoteliers will be pushing to fill their rooms. This of course will ultimately drive RevPAR down,” added Panayotis.

According to MKG Hospitality, the economy should slowly recover in 2010-onwards, and when it does, the country will see many major hotel developments.

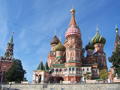

Hilton is one of many hotel brands who have identified Russia as a key market, with major plans for the future. “Russia represents one of the greatest potential for hotel growth in the world today and we are certainly entering at a pivotal time in its economic development. Over the next ten years, we anticipate that we could see more than 70 Hilton Family hotels across key Russian cities and regional centres,” revealed Vice President Development for Northern Europe, Hilton, Mike Collini.

ADVERTISEMENT

Accor is another group with high hopes for the Russian market. Director of Operations for Russia and CIS, Accor, Alexis Delaroff said: “We will have one or two hotels in each city with more than one million inhabitants. We are also looking at niche cities, where industrial and/or touristic potential is promising. We have over 30 signed contracts all over Russia - from Kaliningrad to Irkutsk, and from Murmansk to Sochi. This is the strength of our portfolio of brands that allow us to find an answer to each specific request of each specific location,” added Delaroff.

Improved accessibility from key feeder markets, such as Western Europe and the US, combined with increased wealth and mobility of domestic travellers are all key factors for the growth in Russia’s tourism and hotel industry in recent years. The country’s economic growth over the last decade is also fuelling major infrastructure projects for foreign investors, whilst opening new doors for MICE business.

With the rise of local brands and the growing interest of international chains, Russia promises to be the world’s next major playground for hotel investors. Together with an accommodation undersupply, short payback periods and high average daily rates, the country remains a very lucrative market.

“Once economic recovery kicks off, there is likely to be built-up demand. At very least, companies should be well-prepared and ready to go,” concluded Colette Ambiehl, Senior Consultant and Director, MKG Hospitality Russia.

——-