Breaking Travel News interview: Dermot Mannion, deputy chairman, Royal Brunei Airlines

Dermot Mannion was appointed deputy chairman with Royal Brunei in November 2010

Dermot Mannion was appointed deputy chairman with Royal Brunei in November 2010 In 2011 Royal Brunei Airlines was forced to cancel a number of long-haul routes as economic pressure made continued expansion untenable.

Now, with an overhaul of its routes complete, the Boeing Dreamliner set for delivery and a new base at Brunei International Airport under construction, the mood at the carrier could not be more different.

Here Breaking Travel News sits down with deputy chairman Dermot Mannion to find out how Royal Brunei rediscovered its wings.

Breaking Travel News: When you were forced to cancel routes in 2011 did you feel this would be a long-term downturn for Royal Brunei, or were you confident you would always bounce back?

Dermot Mannion: Sometimes in business you have to take one step backwards in order to take two steps forward.

This is exactly what we have done here. Our ownership has taken the timely but difficult decision to rationalise the long haul network of Royal Brunei Airlines.

In future, our long haul strategy will be to focus exclusively on daily same time services to London, Melbourne and Dubai, which are of key strategic importance to the country.

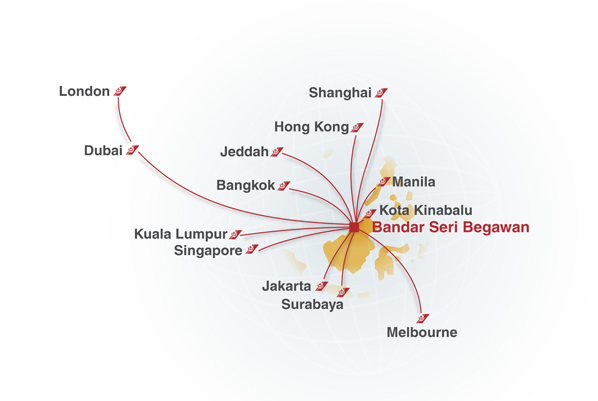

Royal Brunei offers a predominantly short haul network, while focusing on a small number of important long haul destinations

BTN: In what ways will the Dreamliner alter operations at Royal Brunei? Can you outline which routes the aircraft will be used on?

DM: In October 2013, RBA will become the first airline in south-east Asia to introduce the Dreamliner into commercial service.

This new aircraft will be a ‘game changer’ both for RBA and indeed the entire industry, incorporating the ‘best in class’ passenger comfort and amenities.

Daily services to Dubai, London and Melbourne will provide work for at least four

B787 Dreamliners currently on order from Boeing.

The disposition of unit number five has not yet been decided.

BTN: In what ways could the government of Brunei, the owners of the carrier, offer more support?

DM: In the two years I have had the privilege of serving as deputy chairman the support of our ownership has been tremendous.

Firstly, in guiding the airline through a difficult but ultimately successful restructuring process.

Secondly, the decision to commit to a $250 million refurbishment project at Brunei International Airport has been a timely boost to the airline.

Finally, the collaboration between RBA and Brunei Tourism is excellent and a number of very successful joint road show events have recently taken place in London and Melbourne, with more to follow.

The carrier is based at Brunei International Airport

BTN: How will the developments at Brunei International Airport benefit the airline?

DM: The renovation and upgrading of facilities at Brunei International Airport is perfectly timed to coincide with the entry into service of the ‘state of the art’ B787 Dreamliner.

The airport refurbishment is expected to be completed by 2014 and will incorporate upgraded and more comfortable boarding gate and lounge facilities.

This will enable RBA and Brunei Tourism to better showcase the best of what Brunei has to offer both in the air and on the ground.

BTN: Do you feel Royal Brunei has the potential to develop into a dominant regional position - modelled on the success of Emirates, Etihad and Qatar Airways in the Middle East?

DM: RBA is primarily a regionally focused boutique airline competing with ‘the best of the rest’ across our extensive short haul network, while focusing on a small number of important long haul destinations.

Our aim is to carve out a strategically important position for RBA in the regional market and we are well on the way to achieving that objective.

BTN: What challenges does the location of Brunei - with its close proximity to airline hubs in Singapore and Bangkok - pose for the airline? Similarly, what advantages does the position at the heart of the world’s fastest growing aviation market confer?

DM: The key to the future is Brunei’s position at the heart of the world’s fastest growing aviation market.

Brunei already has a programme to actively encourage tourism and new investment in the local economy as part of its diversification strategy away from oil and gas.

For RBA, this presents new opportunities to create new traffic flows for the airline.

As of June 2012, Brunei Tourism has recorded a grand total of 106,924 visitors this year alone with over 20,000 coming into Brunei for Business and over 40,000 coming into Brunei for holiday.

Airline competition in the region is intense but we are confident a rebranded and slimmed down RBA can more than hold its own.

Royal Brunei is famed for its world-class customer service

BTN: Can you tell us a little about the re-branding expected from Royal Brunei next year?

DM: The hospitality and customer service ethos of the Brunei people is already of a very high standard.

In addition, the workforce in Brunei is talented and well educated which will be our trump card for the future. In anticipation of the re-branding process, we have already successfully implemented a substantial soft skills training program for all customer facing staff.

The re-branding process itself is now in full swing.

In the period leading up to the entry into service of the B787 Dreamliner in October 2013, a new livery will be rolled out with all related collateral materials.

The objective is to create a new bright and vibrant image for the airline at all of our customer touch points.

BTN: Is the cost of fuel among the most significant challenges faced by Royal Brunei at present? Can you outline what other challenges the airline faces in the difficult economic climate?

DM: The biggest challenge for all small airlines especially in tough times is to stay ‘relevant’ in an already crowded marketplace.

For RBA this means concentrating on the regional markets we know best, supplemented by a small number of strategically important long haul routes.

The scattergun approach simply does not work for small carriers and RBA’s recent restructuring is designed to make us more selective and focused.

Interview with Chris O’Toole